Residential Tenancies Amendment (COVID-19) Regulation 2020 Residential Regulation

After several weeks of negotiations between the Federal Government and the Individual State Governments it was decided to allow each state to set their own rules for Residential Tenancies during the COVID-19 pandemic.

The NSW Government has passed its amendments and the following is a brief breakdown.

New Changes Commenced on 15 April 2020.

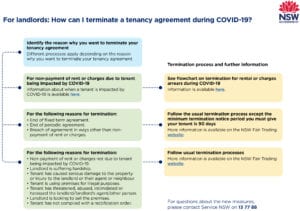

- The Regulation prohibits a landlord from doing the following for 6 months after 15 April 2020 (moratorium period):

a) giving a tenant(s) who is a member of a household that is financially impacted by the COVID-19 pandemic (impacted tenant) a termination notice for non-payment of rent or charges;

b) applying to NCAT (NSW Civil and Administrative Tribunal) for a termination order relating to a termination notice given to an impacted tenant for non-payment of rent or charges; or

c) otherwise applying to NCAT for a termination order solely on the ground that an impacted tenant has failed to pay rent or charges.

- A household is impacted by the COVID-19 pandemic if:

a) any one or more rent-paying tenants in the household have:

i. Lost employment or income as a result of the impact of the COVID-19 pandemic;

ii. had a reduction in work hours or income as a result of the impact of the COVID-19 pandemic; OR

iii. had to stop working, or materially reduce the tenant’s work hours because of:

1. the tenant’s illness with COVID-19;

2. another tenant of the household’s illness with COVID-19; or

3. the tenant’s carer responsibilities for a family member ill with COVID-19; AND

b) as a result of any of the matters stated in paragraph (a) above, the weekly household income has been reduced by at least 25% compared to the weekly household income before the occurrence of any of the matters.

(“weekly household income”) means the total of the weekly income, including any government payments, received by each rent-paying tenant of the household.

- A landlord cannot list an impacted tenant on a residential tenancy database for the non-payment of rent or charges.

- NSW Fair Trading is offering a dispute resolution process if no agreement can be reached between the parties or if they prefer that option.

i. Either party may apply to NSW Fair Trading to use their dispute resolution process;

ii. However who ever applies to NCAT must have exhausted all good faith negotiations;

iii. NCAT is likely to have regard to NSW Fair Trading’s involvement if mediated resolution is unsuccessful; and

iv. NCAT will also consider if a party has refused to participate in good faith negotiations and making a reasonable offer about rent.

No Change; Existing Law Applies

- Clause 41D(2)(b) – Although this clause in the Regulation requires a 90-day notice period to be given when ending a periodic agreement on no grounds, section 85 of the Act already requires a minimum termination notice period of 90 days. In effect, there is no change by this clause in the Regulation.

- Nothing has changed with respect to terminations for the following reasons (noting that termination orders are made by NCAT for these grounds, except with respect to section 88):

a) the non-payment of rent or charges not due to the tenant being impacted by COVID-19 (section 88);

b) the landlord is suffering hardship (section 93);

c) the tenant has caused serious damage to the property or injury to the landlord, their agent or neighbour (section 90);

d) the tenant is using the premises for illegal purposes (section 91);

e) the tenant has threatened, abused, intimidated or harassed the landlord, landlord’s agent or other person (section 92);

f) the landlord has sold the premises (section 86); and

g) the tenant has not complied with a rectification order (section 92A).

Rental losses

When this Residential Tenancy Amendment was announced for the COVID -19 Pandemic it was also announced there would be $440 million in funding from the NSW Government.

Treasurer Dominic Perrottet said the Government was allocating around $440 million towards rent relief in the form of land tax waivers or rebates – with the expectation that this would be split approximately evenly between business and residential landlords.

Mr Perrottet said residential landlords would be eligible for a land tax waiver or rebate of up to 25 per cent if they passed the saving on to tenants in financial distress.

However outside of this, the NSW Government is recommending on their website that Landlords should seek to negotiate with their lender to try to obtain an agreement to waive or reduce mortgage repayments.

Whilst we have had many discussions with many owners and tenants about rent relief, there has been many different outcomes reached between parties.

Some owners are giving rent relief in the form of a temporary reduction that does not need to be paid back at the end whilst other owners are giving a temporary reduction that is required to be paid back in the future.

There is no right or wrong way to negotiate this situation other to try and come up with a solution that works for both the tenant and Landlord.