Insights into the Local Property Market

Whether you’re looking to sell for a change of lifestyle, or considering buying an investment property as part of your investment strategy, spring traditionally has been the time when more properties come to market.

CoreLogic’s latest analysis shows an average uplift of 18.2% in fresh listings and 8.3% for sales over the past decade. But this analysis is at a national level.

At a more local level, we know the demand for properties in Newcastle and Lake Macquarie continues to grow. It is being driven by a combination of factors, including people wanting lifestyle changes, more affordable living compared to Sydney, and ongoing urban development projects creating more job opportunities.

Further fuelling the demand for residential properties, according to the Australian Bureau of Statistics (ABS), our region’s population has grown by 1.3% annually. A quick search on the ABS’s regional data portal reveals for Newcastle and Lake Macquarie:

- Estimated resident population (no.) 2023: 401,892

- Median age – persons (years) 2022: 39.6

With our region being such a desirable place to live, here’s a dig deeper into what has been happening in the property market at a local level.

Andreissons Local Property Report

In our July Local Property Report, we take a look at sales and rentals data for Cardiff, Cardiff South, Cardiff, Cardiff Heights, Cameron Park, Garden Suburb, Glendale, Macquarie Hills, Barnsley, Elermore Vale, Wallsend, Argenton, Edgeworth – Postcode 2285.

- Sales market

The Newcastle and Lack Macquarie property market continues to be strong, with plenty of properties being sold within 30 days on the market.

In the 13 suburbs we cover in this report, there has been solid growth, with an average increase of 8.6%. Cardiff Heights was the highest achieving suburb with an increase of 14.4%, while Barnsley was the lowest performing at 3.5%.

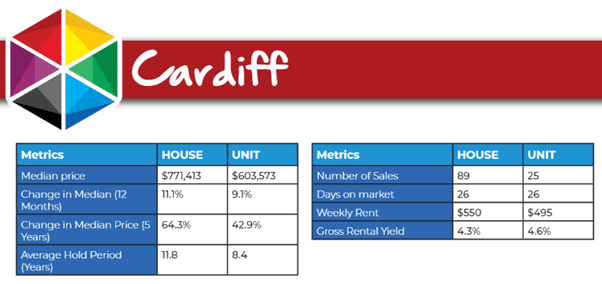

In our report, we include the median price, change in median price (12 months), change in median price (5 years), and average hold price (years).

For instance, in Cardiff, where we are based, this is what the data looks like:

Over the past 12 months, all the properties we put on the market sold, and the majority exceeded client’s price expectations.

- Rental market

As you can see in the above table, as a guide for those thinking of purchasing a property as an investment, we’ve also included the Weekly Rent, and Gross Rental Yield in our suburb report.

What is an important factor is choosing the right Property Management Agent to ensure your property isn’t sitting empty for an extended period of time, and that you’re getting an income according to the market value.

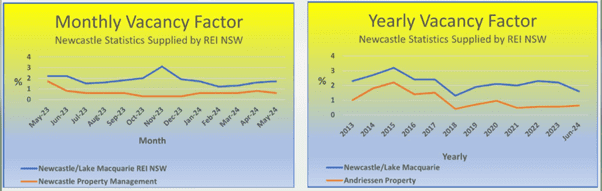

We continue to outperform other property management agencies in the area; comparing our data to Real Estate Institute of NSW (REI NSW), we consistently quickly find quality tenants, and our vacancy rates are lower than average:

How do we do this?

We have a strong Property Management team headed up by Kellie Andriessen. She has been working with us for 35 years, and as an investor herself, she knows how important it is for investors to have peace of mind that their property is in good hands.

She constantly goes above and beyond, and delivers an amazing service – so much so she has been named as a finalist in the REINSW 2024 Awards for Excellence; we have everything crossed for Thursday, 12 September 2024 when the winner is announced at the Awards for Excellence Gala Dinner in The Star Entertainment Centre in Sydney.

Whether it’s managing your investment property, or selling your home, with nearly 50 years in real estate and property management, our experienced and passionate team is constantly looking for new and innovative ways to ensure you get the best outcomes from your property.

This is why we are one of Newcastle’s longest established real estate agencies, so give us a call on

02 4954 8833, send us an email to mail@apnewcastle.com.au or pop into our Cardiff office for a chat.