Our Comprehensive Guide to Building your Dream Home

Designing your own home is an exciting, highly personal journey that allows you to create a space that truly reflects your tastes, lifestyle, and needs. However, it’s also a complex process that requires careful thought and planning. From the layout to materials, energy efficiency to future-proofing, there are countless decisions to make. Here is our.

5 fears of property investment and how to overcome them

Halloween is traditionally the scariest night of the year, but don’t let investing in property add to the fear factor! Here we take a look at five fears people have of investing in property and suggest ways to overcome them. 1. Financial commitment and risk Fear: One of the biggest fears related to property investment.

How to avoid a nightmare house move

Moving house is potentially one life’s most stressful experiences. From packing up your entire life to navigating the logistics of a new home, it’s easy to feel overwhelmed, and suddenly find you’re having a complete rush just before completion date trying to get everything done. A house move doesn’t have to be a nightmare; with.

3 Ways First-time Property Buyers Can Get Help to get on the Property Ladder

While the latest ABS lending indicators around new loan commitments show first home buyers in New South Wales fell 3.7 %, below the national average fall of 1.5 %, they are still keen to get on the market. Here are two ways: 1. Buy into Strata In its latest NSW Market Update, property data specialists.

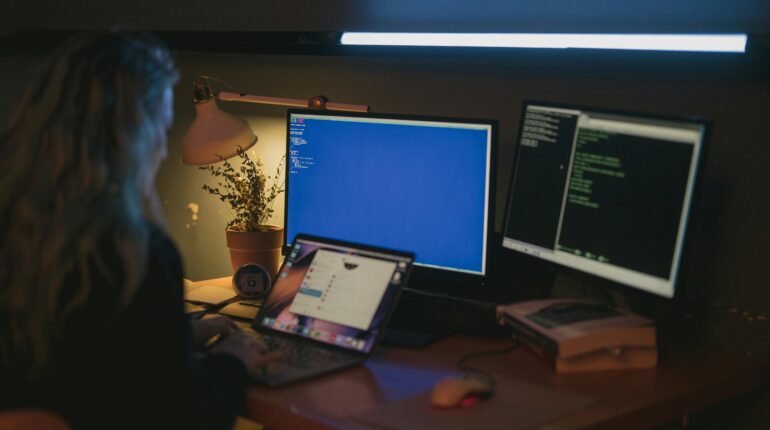

Cyber Security Awareness Month; Cyber Security is Everyone’s Business

October is Cyber Security Awareness Month, a time for all Australians to talk about cyber security and take action to protect their devices and accounts. The theme for Cyber Security Awareness Month 2024 is Cyber security is everyone’s business. And it is everyone’s business. In recent years, property transactions have increasingly been targeted by cybercriminals looking.

Property vs Shares: An Investment Showdown

There’s always on ongoing debate between property and shares as to which is the best investment. Each has its advantages and drawbacks, and the right choice depends on various factors including personal preferences, risk tolerance, investment goals, and market conditions. As with any investment decision, conducting thorough research and seeking advice from specialists in that.

Understanding Capital Gains Tax Implications on the Family Home

Many people are able to remain in their family home until they pass, however when they do pass, dealing with financial issues, knowing what to do and making important decisions, while managing your own emotions at a challenging time isn’t easy, not to mention time consuming and confusing. So, it’s essential you are aware.

The Winner Is… Kellie Andriessen!

We are absolutely delighted Kellie Andriessen, our Property Management Team Manager, has received the prestigious Tim Anderson OAM Residential Property Manager award in the REINSW (Real Estate Institute NSW) Awards for Excellence. This award is for outstanding achievement by individuals in residential property management. Recognising exceptional industry achievement, these highly regarded industry awards are the.